What Happens If Your Car Gets Stolen Without Insurance? (2025 Guide)

Types of Auto Insurance Coverage Explained

April 17, 2025

What Is Homeowners Insurance and Why Is It Important?

April 21, 2025Imagine waking up one morning, only to find your car missing with no insurance coverage to rely on. It is a stressful and overwhelming situation that can happen to anyone.

In this guide, I will explain what realistically happens when your car is stolen without insurance, what immediate actions you should take, and how you can better protect yourself in the future.

Immediate Steps to Take After a Car Theft

If you discover your car has been stolen, taking quick and correct action is crucial to increase the chances of recovery and protect yourself legally.

- Report the theft to the police: File a police report as soon as possible with all necessary details.

- Provide detailed vehicle information: Share the VIN, license plate number, make, model, and color to aid the investigation.

- Notify the DMV: In some states, you must inform the DMV so they can update the vehicle's status.

- Check local tow lots: Sometimes cars are mistakenly towed; confirm with tow companies before assuming theft.

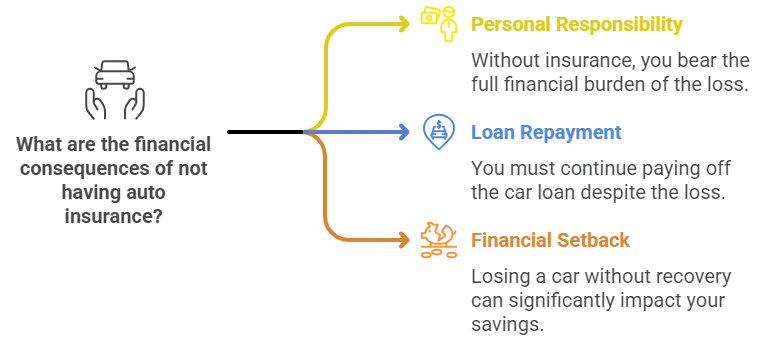

Financial Consequences Without Auto Insurance

Without insurance, the financial burden of a stolen car falls entirely on you, making recovery much harder.

- Personally responsible for the loss: You won’t receive any payout or compensation for the stolen vehicle.

- Continue paying any outstanding loan: If you financed the car, you must still pay off the loan even without the car.

- Risk of major financial setback: Losing a car without recovery can seriously impact your savings and daily life.

What Legal and Administrative Issues Should You Know?

Even without insurance, you have legal responsibilities after your car is stolen.

- Properly file a theft report: You must report the theft accurately to law enforcement to avoid legal complications.

- Impact on your driving record: If your stolen car is used in a crime, your name could initially be linked until cleared.

- Lienholder payment obligations: If you financed the car, the lender can still require full loan repayment.

Can a Stolen Car Be Recovered?

Reporting quickly and knowing the process can increase your chances of getting your car back.

- Chances of recovery: Around 50-60% of stolen vehicles are recovered, but conditions vary.

- Faster reporting improves recovery odds: The sooner you report, the higher the chances police will locate the vehicle.

- Condition after recovery: Many recovered cars are damaged, stripped, or no longer drivable.

Can You Get Any Compensation Without Insurance?

Without comprehensive auto insurance, options for recovering losses are very limited.

- No comprehensive insurance = No payout: You won't receive any reimbursement for the stolen car itself.

- Credit card protection (rare cases): If you bought the car or major parts recently with certain credit cards, limited protections might apply.

- Homeowners' or renters' insurance: These policies may cover personal items stolen from the car, but not the vehicle itself.

What Are the Key Lessons to Protect Yourself in the Future?

Being proactive is the only way to avoid serious losses from car theft.

- Carry comprehensive insurance: It covers theft and protects your financial investment.

- Consider gap insurance: If you’re financing a new car, gap insurance covers the loan balance if the car is stolen and totaled.

- Install anti-theft devices: Alarms, tracking systems, and immobilizers reduce theft risk and can lower insurance costs.

FAQs About Car Theft and Insurance

What insurance covers car theft?

Comprehensive insurance covers theft of the vehicle and sometimes damages if it’s recovered.

Can you finance another car if your stolen car wasn’t insured?

Yes, but you must continue paying the existing loan unless the lender agrees to other terms.

Does car theft affect your credit score?

The theft itself doesn’t affect your credit score, but missing loan payments on the stolen car can.

How long does it take the police to find a stolen car?

If a stolen car is recovered, it usually happens within the first 48 to 72 hours, but recovery isn't guaranteed.

Will having a stolen car on record affect future insurance rates?

Yes, insurers may view you as a higher risk, which could increase your future insurance premiums.

Conclusion

In summary, without auto insurance, you are fully liable for the financial loss if your car is stolen. You would also remain responsible for any remaining loan balance on the vehicle, even if it is not recovered. It’s crucial to safeguard yourself from these risks by selecting the appropriate coverage.

To protect your future and ensure peace of mind, consider obtaining a personalized quote by completing a short form.